Your Comprehensive Guide to Crypto Yield farming

Yield farming is reshaping the crypto landscape, emerging as a key player in DeFi’s explosive growth. This strategy, known for turning digital assets into dynamic investments, has caught the attention of the market, from beginners to crypto veterans. Today, we will explore what makes yield farming a key trend and how you can get started to potentially grow your crypto portfolio. Let’s get right into it!

What is Yield Farming in Crypto?

Yield farming transforms your cryptocurrency holdings into a source of potential rewards. At its core, it is about utilizing your digital assets by lending them out via innovative smart contracts. These digital agreements facilitate the lending process, and as compensation for your participation, you receive fees, paid out in cryptocurrency.

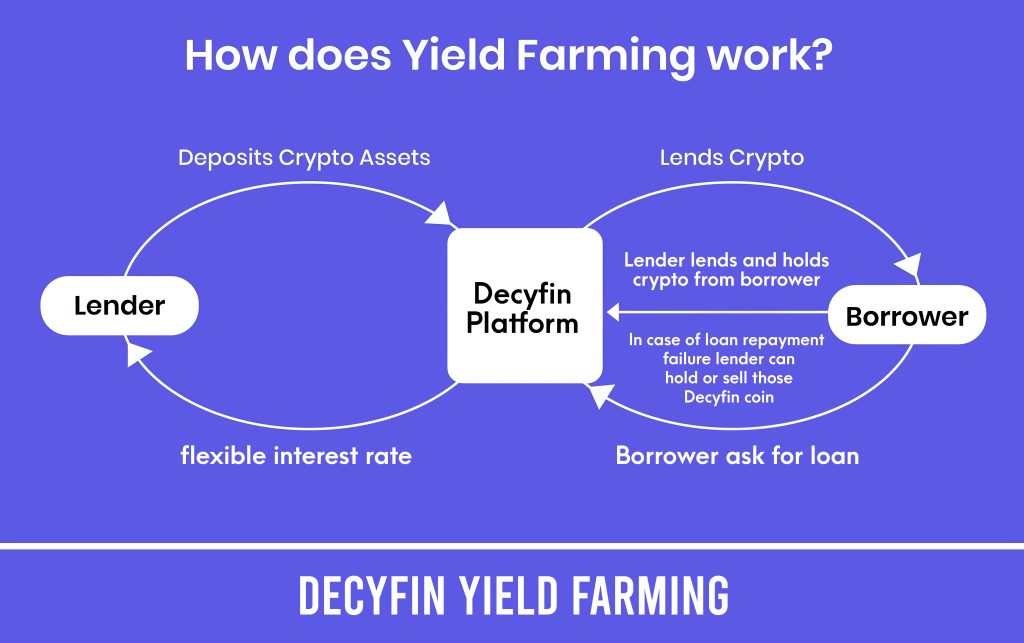

The concept borrows from the traditional finance world, where investors earn interest on their capital. However, in the realm of crypto, yield farming strategies can be more complex and varied. Here, it is not just about lending and earning interest; yield farming strategies can involve multiple transactions using various DeFi platforms and often require a good understanding of the market dynamics. Decyfin Yield farming involves a profit sharing scenario, no fixed interest is paid.

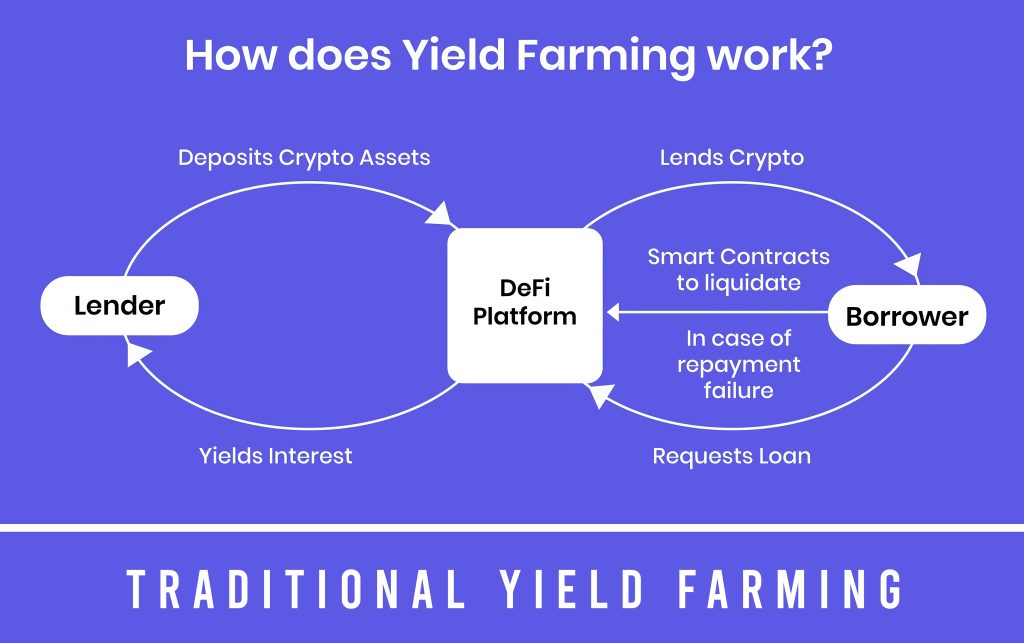

How Does Crypto Yield Farming Work?

Yield farming works by leveraging liquidity protocols. These protocols provide a decentralized marketplace where users can lend or borrow cryptocurrencies. As a yield farmer, you would typically lock up, or “stake,” your crypto assets in a liquidity pool. This pool powers a marketplace where users can lend, borrow, or exchange tokens.

When you deposit your tokens into these pools, you are providing liquidity, and in return, you are rewarded with fees generated from the underlying DeFi platform. These rewards are usually distributed in the form of additional tokens from the platform you are using.

But beware that the reward you earn from yield farming can vary widely and depends on several factors. These include the value of your staked tokens, the demand for borrowing these tokens, the platform’s fee structure, and the overall health of the DeFi market.

Moreover, yield farming often involves staking in multiple liquidity pools. Savvy farmers constantly shift their assets around to pools offering the best returns. However, this practice requires constant monitoring of the market conditions, as the efficiency of different strategies can change rapidly.

Types of Yield Farming

In general, yield farming can be categorized into various types based on the strategies and platforms used. Understanding these types is crucial for anyone looking to get into yield farming. Here are some of the most popular ways to yield farm crypto:

- Liquidity Mining: This involves providing liquidity to a DeFi platform and earning rewards in return. The rewards are often in the form of the platform’s native tokens.

- Staking: Similar to liquidity mining, staking involves locking up tokens in a smart contract to support the operations of a blockchain network. In return, stakers earn rewards, often in the form of additional tokens.

- Lending: Here, users lend their crypto assets to others via a DeFi platform and earn profit in return. The profit rates can vary based on the demand for borrowing these assets.

- Yield Farming Pools: These are pools where users can contribute a variety of tokens. The rewards depend on the pool’s performance and the user’s share in the pool.

- Leveraged Yield Farming: This advanced strategy involves borrowing capital to increase the potential yield, but it also greatly increases the risk.

Benefits of Yield Farming

Yield farming offers several benefits that have contributed to its popularity, such as:

- High Returns: Often, yield farming provides higher returns compared to traditional investment methods. Hence, the dynamic and competitive DeFi environment drives these potentially lucrative rewards.

- Contribution to DeFi Growth: Yield farmers play a vital role in the DeFi ecosystem by providing liquidity, which is essential for the functioning of decentralized exchanges and other DeFi applications.

- Token Rewards: In addition to profit earnings, yield farmers often receive new tokens as rewards. These tokens can sometimes appreciate rapidly in value.

- Diversification: Yield farming allows investors to diversify their crypto portfolio. By engaging in different DeFi platforms and strategies, farmers can spread their risk.

Risks of Yield Farming

While yield farming can be profitable, it is essential to be aware of the risks:

- Smart Contract Risks: Since yield farming relies on smart contracts, any vulnerabilities in the contract code can lead to loss of funds.

- Impermanent Loss: This occurs when the price of your deposited assets changes compared to when you deposited them. This can lead to losses even if you are earning rewards.

- Liquidation Risk: In leveraged yield farming, if the market moves against you, there is a risk of liquidation, where you could lose your collateral.

- Market Volatility: The cryptocurrency market is highly volatile. Rapid price changes can affect the profitability of farming strategies.

- Regulatory Risks: The regulatory environment for cryptocurrencies and DeFi is still evolving. Changes in regulations can impact the yield farming landscape.

What is the Best Way to Yield Farm Crypto?

The truth is that yield farming strategies can vary in complexity and risk level. However, some general practices can help maximize the potential of your yield farming endeavors. These include:

- Research and Understand DeFi Platforms: Before diving in, thoroughly understand the different DeFi platforms and the specific mechanics of their yield farming strategies.

- Assess the Risk/Reward Ratio: Evaluate the potential returns against the risks involved, such as impermanent loss and market volatility.

- Start Small: If you are new to yield farming, begin with a small investment to understand the process and its risks without exposing yourself to significant losses.

- Diversify Across Platforms and Strategies: Avoid putting all your assets in one pool or strategy. Diversification can help mitigate risk.

- Stay Informed and Agile: The DeFi space is rapidly evolving. Staying informed about market trends and adjusting your strategies accordingly is crucial.

- Use Automated Tools: Consider using automated yield farming tools and platforms that can help in optimizing your strategies.

Is Yield Farming Crypto Worth It?

The answer to whether yield farming is worth it depends on several factors, including:

- Risk Tolerance: If you are comfortable with high-risk, high-reward investments and have a good understanding of the DeFi sector, yield farming can be a lucrative option.

- Market Conditions: Yield farming profitability is closely tied to market conditions. During bullish markets, the returns can be significant.

- Time and Knowledge Investment: Yield farming requires continuous learning and active management. It is more suited for those who can dedicate time and effort to stay on top of the rapidly changing DeFi landscape.

- Long-Term Perspective: It is important to have a long-term perspective and not get swayed by short-term volatility.

But do keep in mind that while yield farming can offer substantial returns, it is not without risk. Therefore, it is essential for each investor to carefully consider their situation and do thorough research before diving in.

Final Thoughts

At the end of the day, yield farming is a balancing act between high risk and potentially high reward in the DeFi space. It is an attractive avenue for investors who are well-informed and proactive. Yet, it is crucial to recognize that alongside the possibility of significant returns come considerable risks. Therefore, a thorough market analysis and a cautious approach to risk management are essential. But remember – substantial rewards can be found in decentralized finance for those who are prepared!