Fund Management: A Deep Dive into Profits, Risks, and Mastery

Dipping your toes into the world of finance and investments can be exciting yet daunting. And with terms like “hedge funds” and “profit-sharing” flying around, it is easy to feel overwhelmed. That is where fund management comes in, the hero that strives to maximize profit while keeping risks at bay. Ready to unwrap the mystery? Let us get started.

Fund Management Basics: What is It All About?

At the heart of any investment strategy lies fund management. And with this, you might be wondering, “What does fund management mean?” Well, think of it as the mastermind behind the investment curtain. Fund management is the art and science of managing capital by strategically investing it across diverse assets to seek out the best returns.

We are talking about investments in stocks, bonds, real estate, and, in today’s digital age, even cryptocurrencies. Regardless of the type of asset, the core objective remains the same: to consistently maximize profit while diligently minimizing risk. Therefore, when it comes to this pivotal task, precision, and strategy are paramount.

The Different Faces of Fund Management: Hedge vs. Internal

As you delve into the finance arena, you will soon realize that the world of fund management is multi-faceted. It is not just about managing funds; it is about understanding which type of fund aligns with specific investment goals.

Hedge Fund Manager

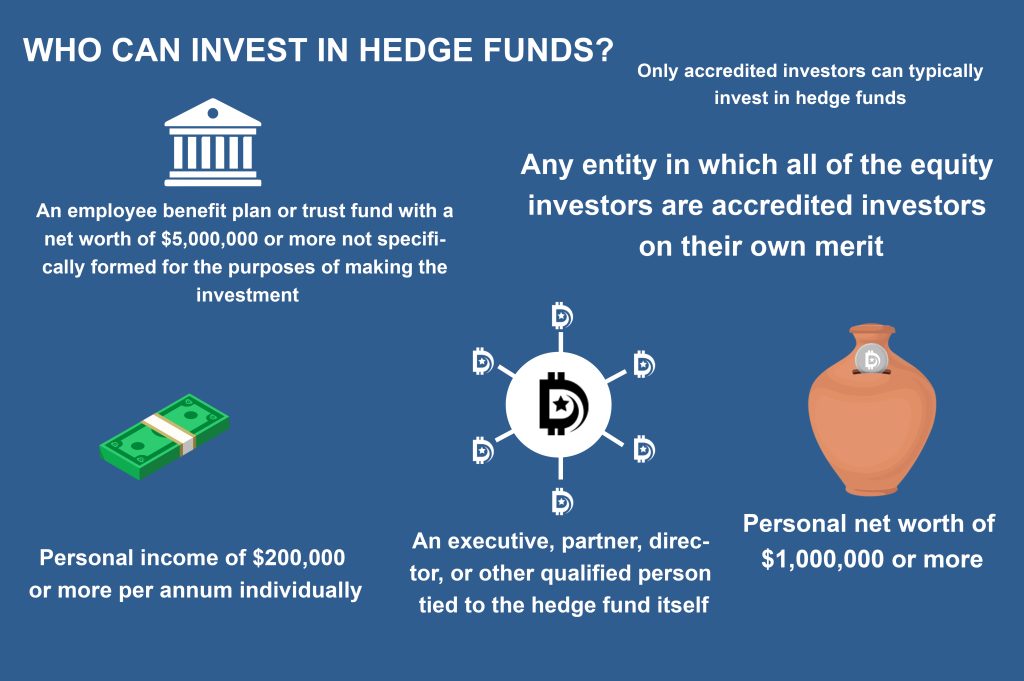

Often touted as the rockstars of the finance world, hedge fund managers commandeer hedge funds. And what are hedge funds, you ask? They are elite pools of capital designed to chase and capture high returns. To achieve this, hedge fund managers employ a myriad of techniques, leveraging being a prime one. This approach, however, also means that they often tread on high-risk grounds.

Internal Fund Manager

On the other side of the spectrum, we have the internal fund managers. These professionals, in contrast to hedge fund managers, typically reside within the walls of large institutions or corporations. Their role is pretty straightforward but equally vital. They are tasked with investing the institution’s internal capital, ensuring that the funds generate the best possible returns. While they might not always be in the limelight, their impact on institutional growth is undeniable.

Actively Investing: The Game of Risk and Reward

Active investment – it is a term that might sound aggressive and for a good reason. Should you be right at the forefront of investment decisions? Or should you take a step back and let the market do its thing? If you choose to be proactive, you are entering the realm of actively managed funds.

Here, fund managers are not mere spectators. Instead, they are continually on the move, buying and selling investments with a singular vision: to outpace market benchmarks. The allure of higher rewards is undeniable. However, and this is crucial, with greater potential rewards come heightened risks. As with all games, there are no guarantees, only strategies, moves, and outcomes.

Understanding the Players: The Fund Management Analyst

Behind every great fund manager is a team of sharp, detail-oriented fund management analysts. While they might not make headlines, their role is indispensable. Imagine a bustling engine room where every cog, gear, and lever needs to work seamlessly.

Fund management analysts are the mechanics ensuring everything runs without a glitch. They dive deep, researching market trends, gathering critical data, and drawing actionable insights. And it is upon their desks, laden with reports, charts, and graphs, that many crucial investment decisions originate. So, while they might operate behind the scenes, their influence resonates throughout the financial spectrum.

The Safety Net: Cash Management

Not every penny is thrown into the volatile market. In fact, a significant part of astute fund management revolves around cautious cash management. Think of it this way: while it is tempting to chase high returns, it is also imperative to have a safe cushion.

Why? To ensure there is ample liquidity not just for the daily grind but also to swiftly capitalize on fleeting market opportunities when they arise. In essence, it is a balance between chasing dreams and sleeping soundly at night.

Guiding Your Path: Fund Management Framework and Guidelines

Imagine embarking on a journey without a map. Sounds chaotic, doesn’t it? This is precisely why fund managers arm themselves with a meticulously crafted framework and a set of stringent guidelines. But what do these guidelines encompass? Everything from ethical considerations that dictate the “do’s and don’ts” to risk parameters that define the boundaries of investment ventures. In the tumultuous seas of finance, these guidelines act as the North Star, ensuring that the relentless pursuit of profit remains on the right track.

A New Age Approach: Staking and Profit Sharing

Venturing beyond the realm of fixed interests, we stumble upon a landscape rife with profit-sharing opportunities reminiscent of dividends. And in the burgeoning world of cryptocurrencies, this takes the form of staking.

But what is staking, you wonder? Imagine being rewarded, not just for the mere act of holding onto a digital asset but also for playing an active role in operations, such as validating payments. It is an enticing prospect: to earn from both the growth of your investment and its very participation in the crypto ecosystem.

Navigating Modern Risks: Fiat Money and Cryptocurrency

But with the digital age comes a new set of challenges and opportunities in fund management. While the traditional world of fiat money, with all its tangible touch and feel, grapples with threats like inflation and changing interest rates, the virtual realm of cryptocurrencies presents its own mosaic of risks.

For example, there is the ever-present shadow of regulatory clampdowns, the unpredictability of market sentiment, and, of course, the inherent volatility of digital assets. But the good news is that understanding these risks is the key to tapping into their full potential.

Mastering the Balancing Act

The bottom line is that fund management is more than just numbers; it is an art and a science. While the goal is to maximize profits, the path is paved with risks and challenges. Whether you are an investor looking to grow your wealth or a curious mind eager to delve into finance, understanding the intricacies of fund management is crucial.

As the landscape evolves with digital assets like cryptocurrencies becoming key players, the essence remains unchanged: It is all about smartly managing funds to achieve the best returns. Armed with knowledge and the right strategies, the world of fund management is yours to conquer.