Understanding Fiat Currency: From Foundation to Function

Exploring today’s financial landscape, you have undoubtedly bumped into the term “fiat currency” more than once. The truth is that with cryptocurrencies taking center stage, it is become imperative to really grasp what sets fiat money apart. So, before diving deeper into the world of digital coins and blockchain, let us pause and shed some light on the age-old foundation of our financial system: fiat currency.

What is Fiat Money?

At the heart of our modern financial system lies fiat money. By definition, fiat money is a currency that a government has declared to be legal tender, but it is not backed by a physical commodity. Instead, its value comes from the trust of the people who use it.

Diving a bit further into the mechanics of the fiat currency system, we understand that the value of a government-issued currency is not reliant on tangible commodities. Instead, it is anchored in the government’s ability to maintain trust and stability in its economy.

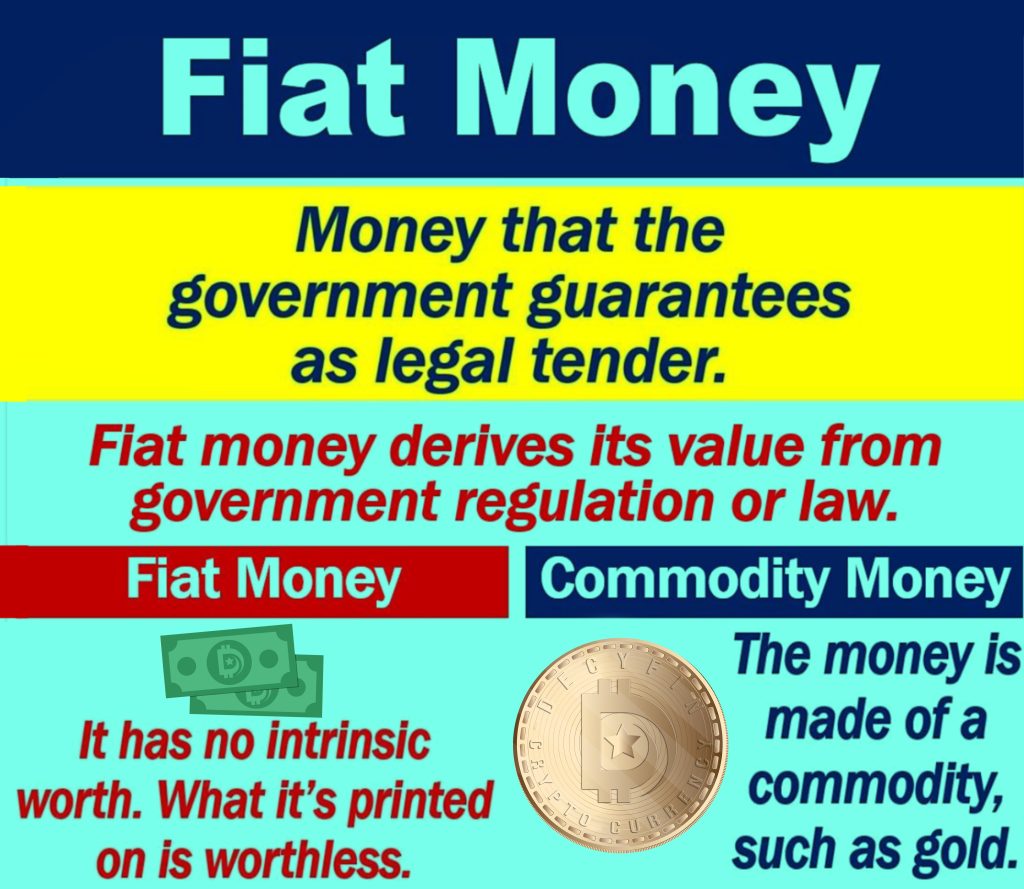

Fiat Money vs. Commodity Money

Financial history offers clear distinctions between various forms of money:

- Commodity Money: This is money whose value comes directly from the material it is made from. Think gold coins; their value is directly tied to the market value of gold itself.

- Fiat Money: In stark contrast, fiat money does not rely on a tangible asset’s value. Instead, its value is derived from the trust and confidence of the people who use it and the backing of the economy in which it operates.

But the comparisons do not end there. Representative money is another form of currency, acting as a claim on a commodity, which can be redeemed upon demand. Fiat money, however, does not offer such physical claims; its value is solely in its established use and trust.

The Evolution of Fiat Money

Money has not always been as we know it today. From basic barter systems to the rigidity of the gold standard, the shift to fiat was a logical evolution in our global economy. Earlier, currencies were tied directly to physical commodities, but as global economies grew and the logistics of commodity-based systems became a challenge, fiat money emerged as the more practical solution, promoting liquidity and trade flexibility.

Fiat Money Functions and Features

Fiat money plays several critical roles in today’s financial systems:

- Medium of Exchange: Recognized within its jurisdiction, fiat money ensures smooth transaction processes between parties.

- Store of Value: Even without a physical commodity backing, fiat money effectively stores value, paving the way for savings and future payments.

- Unit of Account: Crucially, it acts as a benchmark, aiding in comparing the value of various goods and services in the market.

Fiat Money Advantages and Disadvantages

Fiat currency has served as the backbone of modern economies for several decades. However, as with any financial instrument, the fiat system brings with it a blend of advantages and challenges. Understanding these pros and cons is essential for anyone seeking to navigate the intricate waters of global finance.

Pros

- Flexibility in Economic Policies: One of the foremost benefits of fiat currency is the flexibility it grants to governments. They can fine-tune and implement monetary policies, such as controlling inflation or stimulating economic growth, with a degree of agility that might be harder to achieve when money is tied to a physical commodity.

- No Dependency on Commodities: The fiat system stands independent of tangible assets. Governments are not restrained by the need to have an equivalent reserve of gold, silver, or any other commodity. This can be especially beneficial in times of global commodity shortages or fluctuating market prices.

Cons

- Inflation Risks: While the fiat system offers various advantages, it is nott devoid of pitfalls. One significant risk is the potential for inflation. If a government prints money indiscriminately without corresponding growth in goods and services, the purchasing power of that currency can erode, leading to inflationary pressures.

- Potential for Mismanagement: With great power comes great responsibility. The authority to manage and control the money supply can be a double-edged sword. If mismanaged, it can exacerbate economic downturns, causing hardships for citizens.

Fiat Money and Inflation

Inflation is often at the forefront of discussions when it comes to fiat money. The ability of governments to produce currency without being constrained by tangible assets can be both a boon and a bane. While it provides flexibility, it also carries the inherent risk of devaluation. If too much money floods the market without a corresponding increase in goods and services, the result can be inflation, diminishing the currency’s buying power. Yet, it is essential to note that with vigilant oversight, strict regulations, and judicious economic management, such risks can be effectively curtailed.

Cryptocurrency vs. Fiat Money

The financial landscape of today is comparatively different from past eras, with digital currencies such as Bitcoin making waves worldwide. As these cryptocurrencies grow in popularity and adoption, it becomes increasingly imperative to distinguish their differences from traditional fiat currencies.

So what are these? Unlike fiat money, cryptocurrencies operate on decentralized networks, making them immune to direct government intervention or control. This decentralization offers transparency and potential resistance to censorship but also comes with its challenges. On the other hand, fiat currencies, backed and regulated by national governments, offer stability and universal recognition, albeit with potential governmental control and oversight.

The Authority Behind Fiat Money

Behind every piece of fiat currency lies the strength and assurance of an institution. This authority, whether a government or a central bank, governs the creation, distribution, and overall value of the currency. Their word and regulations ensure that the money holds value and that it’s universally accepted within their jurisdiction.

This designation of money as “legal tender” is not merely a term; it is a binding requirement, ensuring creditors recognize the currency for settlements, underpinning trust and confidence in the financial system.

Fiat Money and Fiduciary Money

Fiat money and fiduciary money both play unique roles in the financial ecosystem. While they might appear synonymous to the uninitiated, they have distinct differences that set them apart. Fiat money owes its value to the governmental mandate, a decree that it be recognized as a medium of exchange. This top-down approach contrasts with fiduciary money. Instruments like checks, promissory notes, or even bank drafts are not valuable in and of themselves; instead, their value lies in the trust users place in them. Essentially, they signal a commitment or promise to pay a certain amount in the future.

Intrinsic Value and Economic Implications

At a glance, the intrinsic value of fiat money seems nonexistent. After all, it is merely paper or metal. But its real essence is far more profound! The actual value of fiat currency lies in its embodiment of trust, faith, and the strength of the economy it represents. This trust enables it to facilitate various financial activities, from everyday transactions to complex investment strategies. By serving as a consistent medium of exchange, store of value, and unit of account, fiat money holds the modern economic structure together.

Fiat Currency Failures

As we have said, fiat systems are robust but not infallible. There have been moments in history where the trust in a fiat currency diminished, leading to its catastrophic collapse. One glaring example is the hyperinflation episode in Zimbabwe. Such instances are reminders that a fiat system’s strength is directly proportional to the confidence users have in it. When mismanaged or abused, be it through unchecked printing or dubious policies, the system can unravel.

Sailing Through Financial Tides

As we stand at the crossroads of traditional and digital finance, comprehending the intricacies of fiat money remains paramount. It is more than just paper or coins; it is the lifeblood of our modern economy. Recognizing its strengths, vulnerabilities, and the delicate balance upon which it operates can empower individuals to make informed financial decisions. So, as you navigate the financial waters, remember understanding the currents, like fiat systems, ensures smoother sailing. Safe investing!