Decentralized Platforms: Navigating Risk Management

Decentralized platforms have transformed the financial world by providing investors with new and innovative opportunities. However, like any financial endeavor, they come with their own set of risks. As a result, effective risk management is critical in this decentralized environment in order to protect investor capital and ensure long-term growth. To guide you through this process, the following information breaks down the vital risk management steps these platforms take to keep investments secure.

Understanding Decentralized Risks

Decentralized finance, while presenting a groundbreaking approach to traditional financial mechanisms, brings with it a set of unique challenges and risks. Here are some factors to consider:

- Compared to Traditional Finance: The absence of central authorities or intermediaries, which traditionally offer a layer of checks and balances, leaves DeFi participants largely on their own. This autonomy means users must exercise more caution and due diligence than they might in a conventional system.

- Transparency and Overexposure: The inherent transparency in most blockchains can sometimes be a double-edged sword. While it fosters trust and openness, it can also result in the unwanted exposure of transaction details or even the potential for front-running by savvy onlookers.

- Technical Risks: The operations of DeFi platforms hinge on the flawless functioning of smart contracts. These contracts, while robust, are not impervious to bugs or potential exploits. A minor oversight in code can lead to significant vulnerabilities.

- Market Volatility: Decentralized assets can be highly volatile, with prices subject to rapid and unpredictable changes. This volatility can arise from various factors, including market sentiment, news events, or even the actions of a few major holders or “whales.”

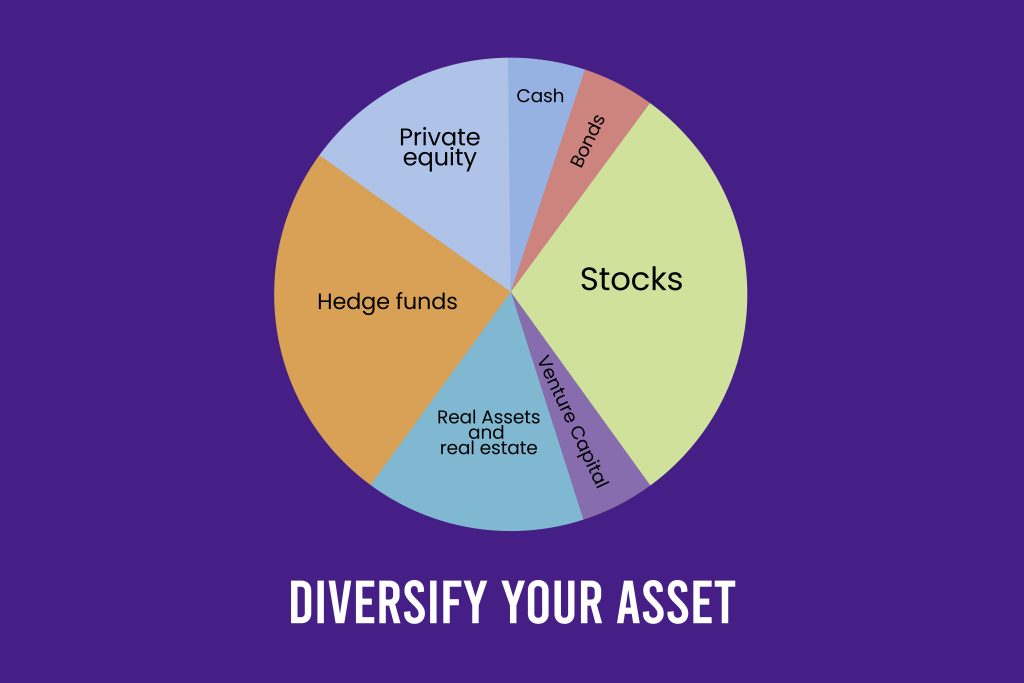

Investment Strategy Diversification

In response to DeFi’s challenges, diversifying investment strategies emerges as a crucial risk management tool. Here is what to know:

Benefits of Diversification

By spreading investments across a range of assets or projects, investors can mitigate the impact of adverse events in any single venture. Essentially, it reduces the potential for drastic losses by distributing the exposure.

DeFi Diversification Avenues

- Yield Farming: An innovative method where investors provide liquidity to a platform, usually in exchange for interest or tokens.

- Staking: Investors lock up, or “stake,” a certain amount of their tokens in a cryptocurrency network to support its operations. In return, they might earn more of that cryptocurrency.

- DeFi Lending Platforms: These platforms allow users to lend out their assets and earn interest over time. Conversely, users can also borrow assets, typically by providing collateral.

When exploring decentralized platforms, having a clear understanding of the inherent risks and employing diversified strategies can be instrumental in ensuring capital safety and growth.

Risk Assessment of DeFi Projects

To successfully venture into decentralized finance, it is essential to understand how to evaluate the countless DeFi projects in the market. Here are some key factors to consider:

Criteria for Viability and Security

- Code Audits: The robustness of any DeFi project lies in its underlying code. Ensuring that the project’s smart contracts have undergone thorough and multiple independent audits can be a significant marker of its reliability.

- Team and Governance: A transparent and experienced team, coupled with a sound governance model, can be the indicators of a project’s commitment to long-term viability and responsiveness to issues.

- User Activity and Volume: Projects with higher user engagement and trade volumes often signify community trust and utility.

Recognizing Red Flags

- Over promising Returns: Projects promising unrealistically high returns can be too good to be true and should be approached with caution.

- Lack of Transparency: If a project is not open about its operations, team, or code, it may indicate potential pitfalls.

- Unaudited Code: Projects that bypass the audit process or are dismissive of discovered vulnerabilities can be riskier ventures.

Liquidation Procedures

Another thing that potential investors should understand is how liquidation functions within DeFi, as it helps in understanding its inner workings:

How Liquidation Works

In DeFi lending platforms, if a borrower’s collateral value falls below a specific threshold, it might get liquidated. This mechanism ensures lenders get repaid. Usually, other participants can purchase the undercollateralized assets at a discount, compensating them for the risk they undertake.

Safeguard Mechanisms

- Collateral Ratios: These ratios mandate borrowers to over-collateralize loans, creating a buffer against market volatility.

- Stability Fees: Some platforms may have fees to adjust for market stability, ensuring the system remains solvent.

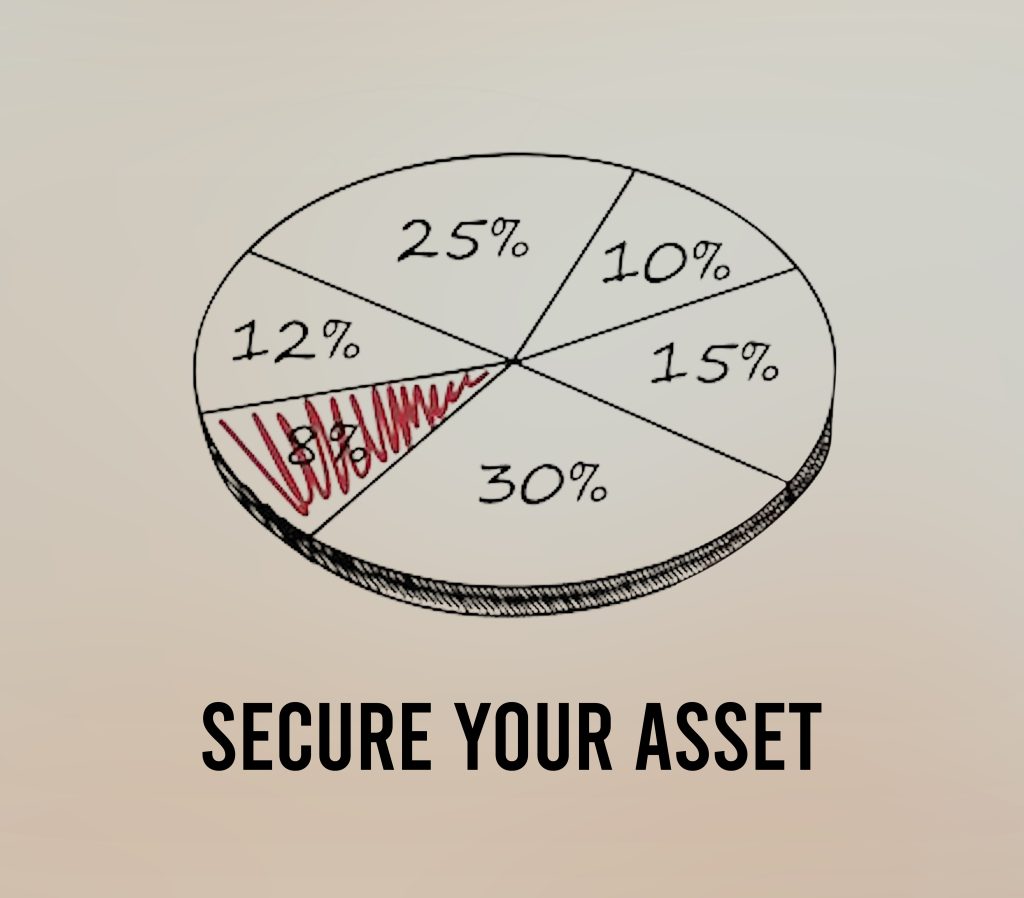

Safeguarding Investor Capital

Another factor to consider in DeFi is that the measures a platform takes to protect investor assets are crucial. Thus, most reputable platforms offer:

Protective Tools and Protocols

- Multi-signature Wallets: These require multiple private keys to authorize a transaction, adding an additional layer of security.

- Time Locks: Some protocols enforce a delay before executing significant changes, allowing users to withdraw funds if they disagree with the changes.

Insurance in DeFi

- Coverage Platforms: Some platforms offer coverage against smart contract failures, providing an added layer of protection for users.

- Pool Safety: Certain DeFi platforms maintain insurance pools funded by platform fees to reimburse users in case of losses.

By understanding these facets of risk management in decentralized platforms, investors can maneuver more confidently, ensuring their capital remains secure in an evolving financial landscape.

The Key Takeaway

The bottom line is that decentralized finance represents a significant shift in the financial industry, introducing both opportunities and challenges. To navigate this space successfully, it is crucial to understand how DeFi platforms address risks. Prioritizing the protection of your assets while staying informed will equip you to make the most of these innovations. As decentralized finance continues to evolve, possessing the right knowledge will be pivotal in ensuring a secure and productive journey.