A Comprehensive Guide to Understanding How Decentralized Exchange Works

Decentralized exchanges (DEXs) have become a cornerstone in the cryptocurrency trading ecosystem. In stark contrast to traditional exchanges, these platforms eliminate intermediaries and cultivate a peer-to-peer trading environment. Eager to learn more about how decentralized exchange works? This article delves into the mechanics, benefits, and considerations associated with DEXs.

What is a Decentralized Exchange?

A decentralized exchange is a platform that operates without a central authority. Thus allowing users to trade cryptocurrencies directly with one another. Unlike centralized platforms, where transactions are overseen and facilitated by an intermediary, DEXs ensure that the users maintain full control over their funds.

How Decentralized Exchange Works

When trading cryptocurrencies, understanding how decentralized exchange works becomes essential. This section delves into the intricate mechanics, discussing everything you need to know.

Blockchain Technology

At the heart of a DEX lies blockchain technology, where every transaction is recorded, guaranteeing transparency, security, and immutability. Thanks to blockchain’s distributed ledger system, transaction records become incorruptible and accessible to anyone. This robust technology not only eliminates the need for intermediaries but also provides users with a decentralized and tamper-proof record of their trades, fostering trust and confidence in the system.

Smart Contracts

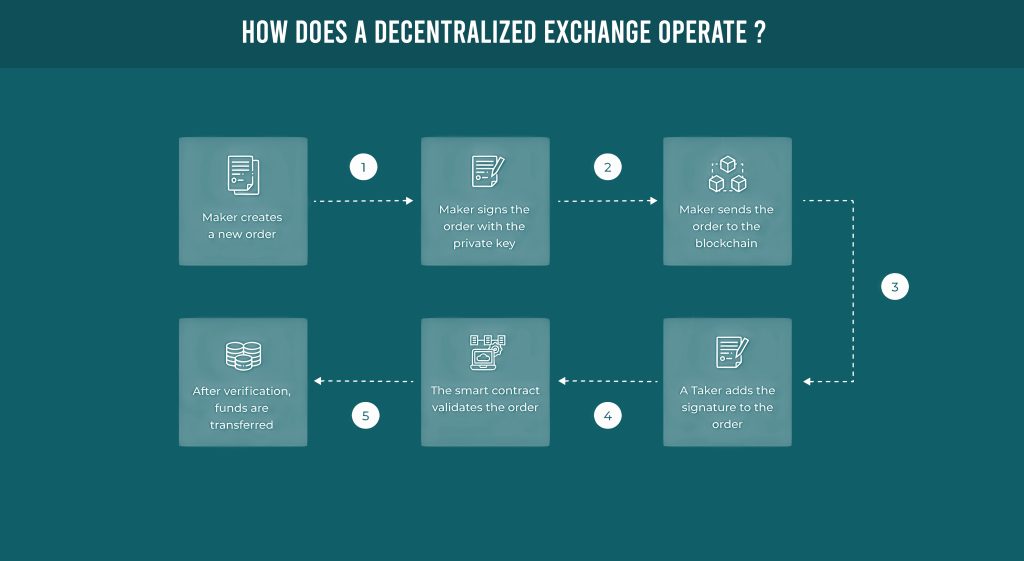

Smart contracts play a pivotal role in facilitating transactions, functioning as self-executing contracts with coded terms and conditions. When two parties agree to a trade, these smart contracts automatically execute the transaction, delivering both speed and security. By eliminating the requirement for intermediaries, they not only reduce costs but also enhance privacy.

Peer-to-Peer Transactions

In a DEX, trades occur directly between users, with the platform merely facilitating these transactions. Therefore, guaranteeing that users maintain full custody of their funds. This direct trading mechanism significantly diminishes the risk of hacking and the mismanagement of funds, enhancing the overall security of the platform.

Advantages of Using Decentralized Exchange

When it comes to cryptocurrency trading, decentralized exchanges (DEXs) offer a compelling alternative to traditional centralized platforms. DEXs bring with them a range of unique advantages that cater to the needs and preferences of crypto enthusiasts. So, let us explore these advantages that make DEXs an appealing choice for traders and investors.

Security

One of the most touted benefits of DEXs is enhanced security. By eliminating the need for users to transfer their funds to the exchange, the risk associated with hacking and theft is significantly reduced.

Privacy

DEXs offer a greater degree of privacy. Since there is no central authority, users are not required to undergo exhaustive verification processes. This feature is particularly appealing to users who prefer to keep their identity and trading activities private.

Ownership

With decentralized exchanges, users retain complete ownership of their funds. This element of control can be a significant advantage, especially in the volatile and uncertain landscape of cryptocurrency trading.

Liquidity

One of the challenges facing DEXs is liquidity. Centralized exchanges often have higher trading volumes, which ensures liquidity. DEXs, on the other hand, are sometimes faced with lower volumes, which can impact the ease of executing large trades.

User Experience

The user experience on DEXs can be different from that on centralized platforms. The lack of an intermediary means that users need to have a more in-depth understanding of the trading process, as they are in complete control of their transactions.

Smart Contract Risks

While smart contracts offer automation and security, they are not immune to bugs and vulnerabilities. Therefore, it is crucial for users to understand this risk and consider platforms that conduct rigorous smart contract audits.

Regulatory Considerations

The decentralized nature of DEXs can introduce regulatory complexities. As traditional financial systems adapt to cryptocurrency, regulatory frameworks are continually evolving. Users should stay informed about the legal landscape in their jurisdiction and consider how it may impact their DEX activities.

Market Volatility

Cryptocurrency markets are renowned for their volatility, and DEXs are no exception. The absence of circuit breakers or circuit limit protections can expose users to sudden and significant price fluctuations. Hence, traders should exercise caution and employ risk management strategies to navigate this inherent volatility.

The Future of Decentralized Exchanges

The evolution of decentralized exchanges is ongoing. With advancements in technology and increased adoption, these platforms are continually improving in terms of security, user experience, and liquidity. Furthermore, the embrace of Layer 2 solutions and cross-chain integrations is an indication of the strides being made to elevate the functionality and appeal of decentralized exchanges.

As the cryptocurrency landscape continues to mature, DEXs are poised to play a significant role in shaping the future of digital asset trading. They embody the fundamental ethos of blockchain technology – decentralization, transparency, and security. For traders who value these principles and are equipped with the knowledge to navigate the intricacies of decentralized trading, DEXs offer a viable, secure, and efficient avenue for cryptocurrency transactions.

Final Thoughts

The bottom line is that understanding how decentralized exchange works is essential for any modern trader. Their rise signals a shift towards a more transparent, secure, and user-empowered form of trading. And while challenges exist, the continuous innovation in this space is a testament to the potential of DEXs in transforming the cryptocurrency trading landscape. By staying informed and vigilant, traders can leverage DEXs to optimize their trading experience in the digital age.