Trading Analysis Tools for Decentralized Exchanges Explained

Decentralized exchanges (DEXs) are revolutionizing the cryptocurrency trading landscape by offering enhanced security, privacy, and control over transactions. In this environment, trading analysis emerges as a vital aspect, aiding traders in making informed decisions based on real-time and historical data. The problem therein lies in the fact that there are so many trading analysis tools on the market that are specifically designed for DEXs. So, how should investors choose the best trading analysis tools for decentralized exchanges? Keep reading to learn more!

Understanding Decentralized Exchanges

The most important thing to know is that DEXs operate on blockchain technology, facilitating direct peer-to-peer transactions and eliminating the need for intermediaries. Hence, each transaction is recorded on the blockchain, guaranteeing transparency, immutability, and security. Moreover, users maintain control over their funds and execute trades via smart contracts, which are automated self-executing agreements operating under predefined conditions.

Importance of Trading Analysis in Decentralized Exchanges

In the dynamic and often volatile landscape of decentralized exchanges, trading analysis stands as a cornerstone for successful investing and profitable trading outcomes. In fact, the complex and rapid movements within the market demand a sophisticated approach to analyze, predict, and respond effectively to market trends. Here are some reasons investors need these tools:

Informed Decision-Making

Accuracy in decision-making is amplified by the depth and quality of information at the trader’s disposal. Trading analysis tools offer detailed insights, from price movements to trading volumes, empowering traders with a wealth of data to base their decisions on. This informed approach fosters confidence and precision in a market where timeliness and accuracy are paramount.

Identifying Trading Opportunities

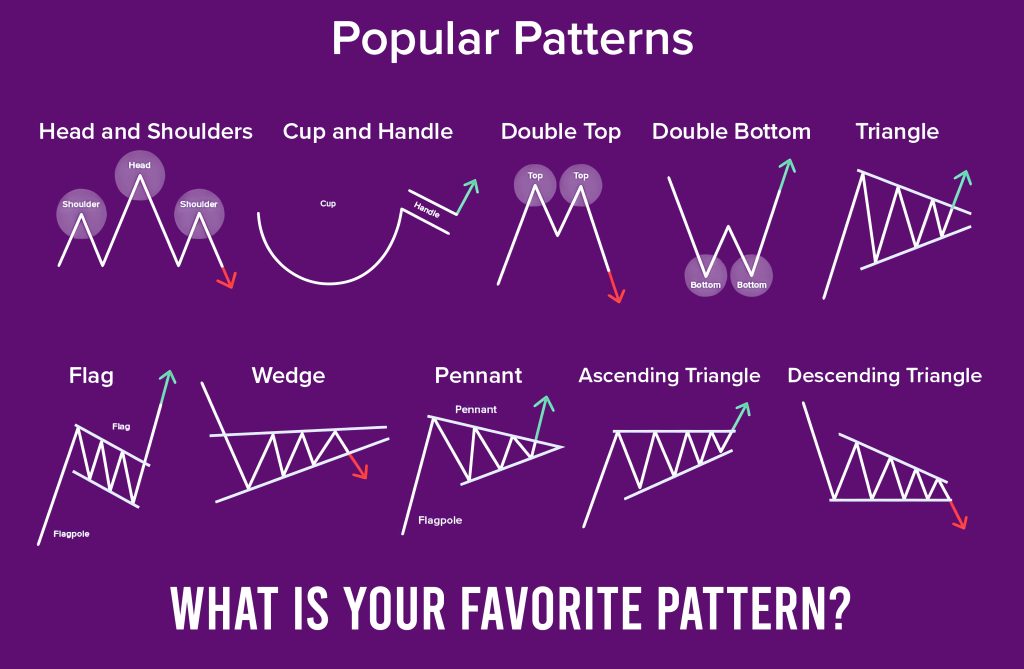

The ability to pinpoint lucrative trading opportunities is enhanced by trading analysis tools. By analyzing patterns, trends, and anomalies in real time, these tools enable traders to identify opportunities for entry and exit. This timely identification and execution are crucial in maximizing profit and capitalizing on the fleeting nature of lucrative trading windows in the cryptocurrency market.

Types of Trading Analysis Tools

As the DEX landscape continues to evolve, a variety of tools have emerged to cater to the diverse needs of cryptocurrency traders. These tools are tailored to offer specialized analyses, insights, and predictions to optimize trading strategies.

Charting Tools

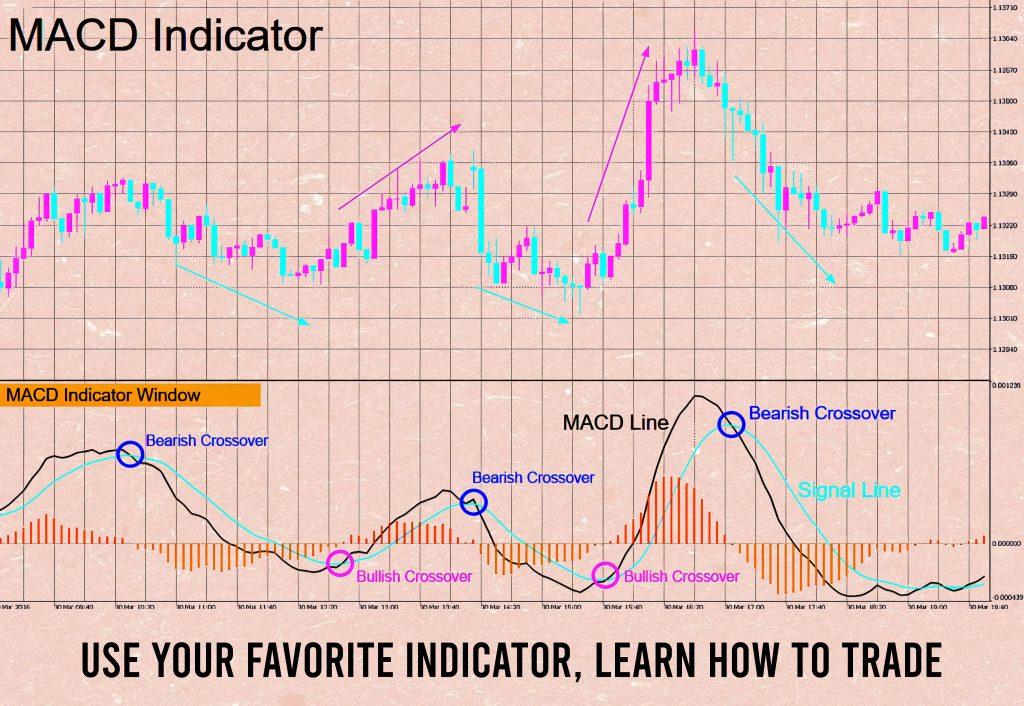

Charting tools are essential for visualizing data in an accessible and interpretable manner. They present data on price movements, trading volumes, and other relevant information in various chart formats. These visual representations allow traders to quickly grasp market trends, analyze patterns, and make informed decisions based on visual data.

Blockchain Analytics

Blockchain analytics tools delve into the transactions recorded on the blockchain. They analyze transaction flows, wallet balances, and other blockchain-recorded data to offer insights into market behaviors and trends. This level of detail is crucial in understanding the undercurrents driving market movements, offering traders nuanced insights on which to base their strategies.

Liquidity Analysis Tools

Liquidity is a pivotal aspect of trading on DEXs. Liquidity analysis tools provide real-time data on the liquidity available on various trading pairs. They analyze order books, trading volumes, and other relevant data to offer insights into the ease of executing trades. This information is vital for traders looking to execute large trades without impacting the market price significantly.

Overview of Popular Trading Analysis Tools

Like most other tools, there are many to choose from. If you are looking for the best tools to get you started, begin here:

Dune Analytics

Dune Analytics stands out for offering comprehensive analytics tailored for decentralized exchanges. It provides insights into various aspects, including trading volumes, liquidity, and wallet activity, transforming raw data into actionable insights. Users can customize dashboards to monitor specific metrics, making it a valuable tool for personalized, in-depth analysis.

Uniswap Interface

The Uniswap Interface is renowned for its simplicity and effectiveness. It offers real-time data visualization, enabling traders to analyze price trends, liquidity, and other vital metrics seamlessly. Its intuitive design makes it accessible for both novice and experienced traders, offering valuable insights to optimize trading strategies.

Other Notable Tools

When it comes to other trading analysis tools, TradingView offers an extensive range of charting tools and indicators for in-depth market analysis. On the other hand, Nansen specializes in providing insights into wallet behaviors, highlighting trends and anomalies that can have a significant impact on market movements. Additionally, Token Terminal offers comprehensive performance metrics, granting users a detailed view of the profitability and utilization of various tokens.

Benefits and Challenges of Using Trading Analysis Tools in DEXs

Trading analysis tools within decentralized exchanges (DEXs) offer a dual-edged landscape for traders. Let us take a look at the benefits and challenges in more detail:

Benefits

Trading analysis tools in DEXs offer enhanced transparency, providing traders with a wealth of real-time data to inform their decisions. These tools improve predictive accuracy, enabling traders to anticipate and respond to market trends effectively. Furthermore, the integration of AI and machine learning amplifies their predictive accuracy, fostering an environment of informed, strategic trading.

Challenges

However, these tools present challenges. The learning curve can be steep, especially for newcomers to the DEX landscape. After all, understanding and interpreting the data and insights requires a level of expertise. Moreover, privacy concerns arise, as the transparency of blockchain means trades and transactions are publicly visible, raising fears about anonymity and privacy.

Conclusion

The role of trading analysis tools in decentralized exchanges is undeniably pivotal. These instruments provide insights, transparency, and predictive accuracy, shaping informed, strategic trading endeavors. As the DEX landscape matures, leveraging these tools will be integral for traders aiming to optimize profitability and mitigate risks, underscoring the necessity of embracing these innovations in the evolving digital trading sphere.