Demystifying How the Decentralized Hedge Fund Works

The financial landscape is evolving rapidly, with decentralized hedge funds leading some of the most innovative changes. And as more investors express interest in this novel approach, understanding how the decentralized hedge fund works becomes crucial. In this article, we will provide a comprehensive overview, ensuring you are well-informed about its inner mechanics and potential advantages in the investment world.

Understanding Blockchain Basics

To fully grasp the workings of a decentralized hedge fund, one must first understand the underlying technology: the blockchain. At its core, a blockchain is a digital ledger, but it is much more than just a list of transactions. Here is why it is instrumental to decentralized finance:

- Immutable Records: Once a transaction is added to a blockchain, it cannot be altered or deleted. This immutability ensures that no tampering takes place, providing a trustworthy record for all participants.

- Decentralized Validation: Instead of relying on a central authority to verify transactions, blockchain uses a network of nodes (computers). Each node has a copy of the entire ledger, and they work collectively to validate and record new transactions. This process, known as consensus, ensures that the information is consistent across the network and is accepted only when the majority agree.

- Enhanced Security: Transactions on the blockchain are secured using cryptographic principles. This means that data is encoded, and without the appropriate cryptographic key, it remains unreadable and secure from potential malicious actors.

- Transparency and Trust: Due to its decentralized nature, every participant can view the entire transaction history. This openness can foster trust among participants, knowing that each transaction is verifiable and unchangeable.

Enter Smart Contracts

However, while blockchains provide a secure environment, it is smart contracts that bring dynamism to decentralized hedge funds. Here’s how:

- Automated Efficiency: Smart contracts operate without the need for human intervention. Once deployed, they cannot be stopped, ensuring that agreed-upon actions happen precisely when conditions are met. This reliability can be essential for timely transactions and distributions.

- Reduced Costs: By automating tasks that typically require intermediaries like banks or lawyers, smart contracts can reduce transaction fees and other associated costs. This reduction can translate to higher returns for investors in the fund.

- Flexibility in Execution: Smart contracts can be programmed for a variety of tasks. Beyond distributing profits, they can be used for automatic reinvestment strategies, risk management practices, or even triggering insurance payouts if certain market conditions are met.

- Transparency and Fairness: Just as with blockchain transactions, the terms and execution of smart contracts are visible to all participants. This transparency ensures that everyone is on the same page and there are no hidden clauses or unexpected behaviors.

- Challenges to Consider: While smart contracts bring efficiency, they are not without challenges. Their irreversible nature means that any flaw in the code can have unintended consequences. This is why rigorous testing and auditing of smart contracts are imperative before they are deployed on a live network.

Community-Driven Decisions

Perhaps the main difference is that, unlike traditional hedge funds, where a central team makes decisions, decentralized funds often leverage community-driven governance. This means that decisions, be it investment strategies or fund adjustments, can be proposed and voted upon by stakeholders. This democratized approach ensures diverse input and decentralizes power, potentially leading to more balanced and inclusive decisions.

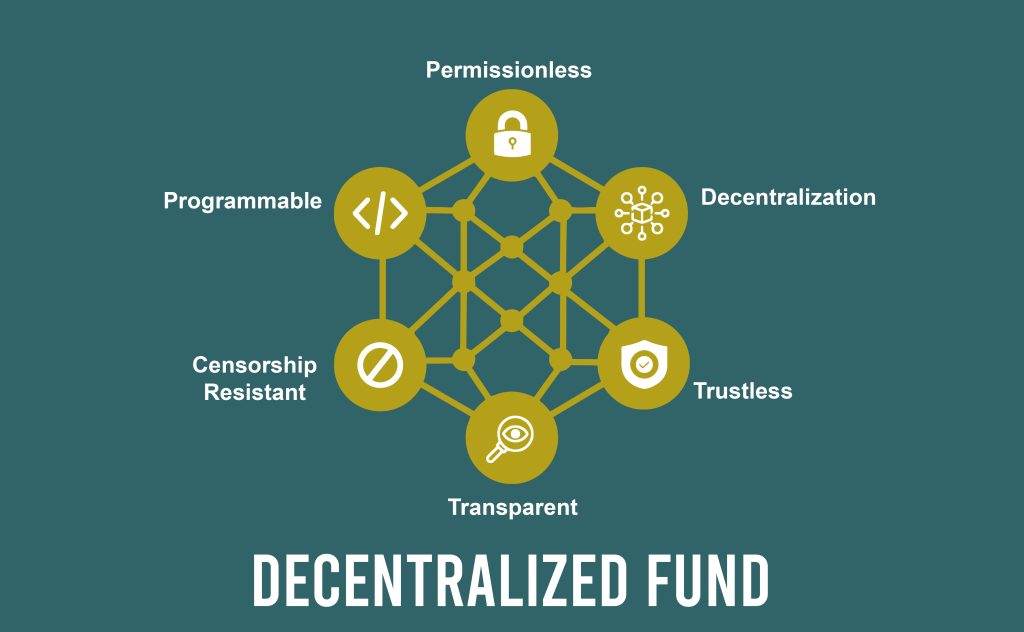

Benefits of Decentralization

The good news in all of this is that decentralized hedge funds not only challenge the traditional investment model but also introduce many advantages. With their unique structure, they offer:

- Transparency: Thanks to blockchain, every transaction and decision is recorded and can be audited by any participant. This level of openness can build trust among investors.

- Accessibility: Traditional hedge funds often have high entry barriers. In contrast, decentralized funds may offer lower minimum investments, allowing more people to participate.

- Efficiency: The automation provided by smart contracts can reduce overhead costs, potentially leading to lower fees for investors.

Potential Downsides and Concerns

However, the innovative approach of decentralized hedge funds also brings forth its set of challenges, including:

- Regulatory Hurdles: The decentralized space is still nascent, and regulations are evolving. There is uncertainty regarding how global regulators will treat these funds, which can introduce risks.

- Smart Contract Flaws: If there is a vulnerability in the smart contract code, funds can be at risk. Proper auditing and security checks are essential.

- Market Volatility: The cryptocurrency market, integral to many decentralized platforms, is known for its volatility, which can impact the fund’s value.

The Role of Tokens

A distinctive feature of many decentralized hedge funds is the introduction of their native tokens. However, these tokens are not just digital assets; they can play pivotal roles in governance, profit-sharing, or as a means of investment within the fund itself.

- Investment Vehicle: Investors might buy tokens, representing a share of the fund.

- Governance: Token holders might have voting rights on fund decisions proportional to their token holdings.

- Rewards and Incentives: Tokens can be distributed as rewards for specific behaviors, like staking, which can stabilize the fund’s assets.

Future of Decentralized Hedge Funds

As with many innovations in the financial world, decentralized hedge funds are likely to evolve. Their growth could drive more mainstream adoption of blockchain technologies, pushing for better regulatory clarity. If they continue to deliver on their promises of transparency, accessibility, and efficiency, they could reshape the landscape of investment funds, making finance more inclusive and democratized.

Final Thoughts

The key takeaway here is that the emergence of decentralized hedge funds is undeniably transforming the investment horizon. By combining the strengths of blockchain with a more inclusive investment model, they are democratizing what was once an exclusive domain.

While it is essential to remain aware of the risks, the potential rewards and innovative nature of these funds are hard to overlook. So, as we look ahead, it becomes evident that decentralized hedge funds might not just be a fleeting trend but a lasting shift in how we approach the world of investment.