A Comparative Analysis: Conventional Hedge Fund Vs Decentralized Hedge Fund

In the investment realm, hedge funds have traditionally catered to affluent investors, with expert teams managing pooled resources for desired returns. Yet, the advent of blockchain and decentralized finance (DeFi) has introduced decentralized hedge funds, revolutionizing transparency and accessibility. But what is the difference? And which is better? This article will provide a straightforward comparison between a conventional hedge fund vs decentralized hedge fund, shedding light on their key differences and similarities to help you determine which is right for you.

What are Conventional Hedge Funds?

Conventional hedge funds are investment pools that aim to earn profits for their investors. Originating several decades ago, they have since cemented their position in the investment world. Managed by adept professional teams, these funds seamlessly pool money from various investors to invest in diverse assets or strategies. Over the years, they have consistently attracted high-net-worth individuals, primarily because of their unique and specialized investment approaches.

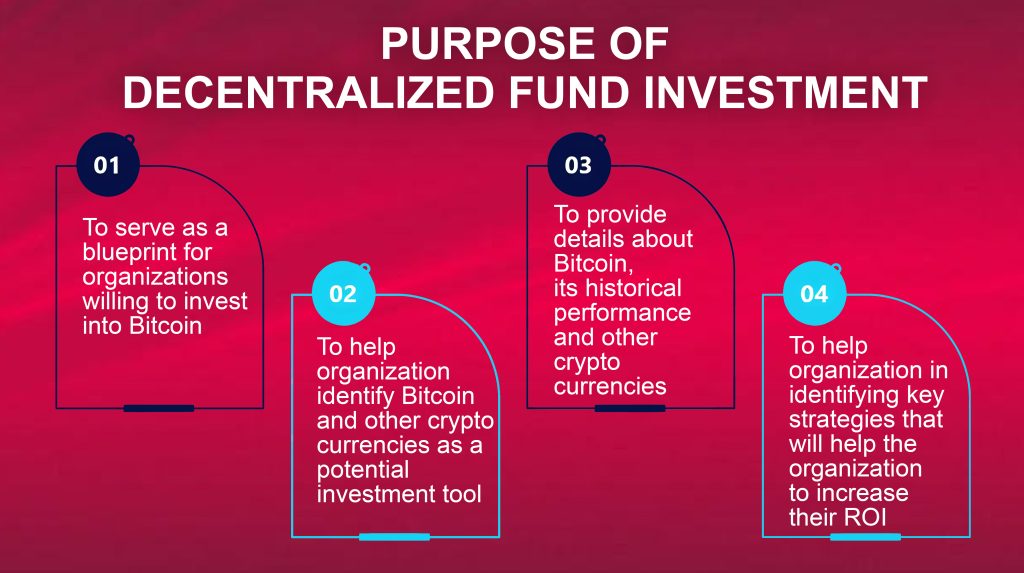

What are Decentralized Hedge Funds?

Decentralized hedge funds operate differently. They are based on blockchain technology, the same tech behind cryptocurrencies like Bitcoin. Instead of a central team making decisions, these funds use smart contracts, or self-executing contracts, with terms directly written into code. Decisions in decentralized funds often come from the community of investors or are algorithm-driven, allowing for a more transparent and democratic investment process.

Comparing Key Aspects

Let us look at the main differences between conventional and decentralized hedge funds in a few key areas.

Management Structure

Conventional hedge funds have a centralized team making decisions. In contrast, decentralized hedge funds often rely on community input or other decentralized decision-making processes.

Accessibility and Entry Barriers

Getting into a conventional hedge fund usually requires a significant investment, making it challenging for many people. Decentralized funds, however, often have lower entry requirements, making them more accessible to a wider range of investors.

Regulation

Conventional hedge funds operate under clear and established regulations. Decentralized funds, on the other hand, are in a newer space, and the rules around them are still forming and can be less predictable.

Transparency

Conventional funds do not always show all their operations to investors. But with decentralized funds, the use of blockchain technology offers a higher level of transparency, letting investors see more of what is happening inside the fund.

Fee Structures and Profit Sharing

Conventional hedge funds commonly use the “2 and 20” fee structure. In simple terms, they charge 2% of assets as a management fee and 20% of profits as a performance fee. In contrast, decentralized funds can offer varied fee structures, often lower, largely because automation reduces overhead costs.

Liquidity Concerns

In a conventional hedge fund, investors might face lock-up periods where they cannot access their money. Decentralized funds, however, typically offer better liquidity, allowing investors more flexibility to move their funds when they want to.

Challenges & Risks: Conventional Hedge Fund vs. Decentralized Hedge Fund

Investing, by its very nature, comes with inherent risks. Whether it is stocks, bonds, real estate, or any other asset class, there is no guaranteed return on investment. Hence, every investor must grapple with the uncertainties of market dynamics, external influences, and myriad other factors that can impact potential returns.

Ultimately, the art of investing boils down to assessing and deciding on the level of risk one is comfortable undertaking. With that understanding, let us explore the distinct challenges and risks posed by both conventional hedge funds and decentralized hedge funds.

Conventional Hedge Funds

- Operational Risks: Managed by human teams, there is potential for errors in judgment, execution, and strategy implementation.

- Liquidity Concerns: Investors might encounter lock-up periods, making it challenging to access funds promptly.

- Transparency Issues: Details about investments, strategies, and operations may not always be fully disclosed, leading to hidden risks.

- Regulatory Scrutiny: Being well-established means they are often under the watchful eyes of regulators, leading to potential compliance issues.

Decentralized Hedge Funds

- Smart Contract Vulnerabilities: Automated by code, any flaw in smart contracts can expose funds to breaches or malfunctions.

- Regulatory Uncertainties: The decentralized finance space is still maturing, leading to a lack of clear guidelines and potential legal challenges.

- Custodial Concerns: The decentralized nature can sometimes blur the lines of asset custody, raising questions about fund safety.

- Platform Dependency: Being reliant on specific blockchain platforms means any issues or changes in those platforms can impact fund operations.

When comparing the two, it is evident that while conventional funds face challenges rooted in their traditional structure and operations, decentralized funds encounter risks emerging from their innovative, tech-driven nature.

How to Choose the Right Hedge Fund for You

When deciding between a conventional and a decentralized hedge fund, it is essential to weigh the following considerations:

- Risk Tolerance: Do you feel comfortable with the newness and regulatory uncertainties of decentralized funds, or do you prefer the tried-and-tested nature of conventional funds?

- Investment Horizon: If you are looking for quicker liquidity, decentralized funds might be appealing. However, if you are in it for a longer haul and can handle potential lock-up periods, conventional funds might be suitable.

- Transparency Preference: If having a detailed, transparent view of operations and decision-making processes is vital for you, decentralized funds offer this through blockchain technology.

- Fee Consideration: Are you okay with the traditional “2 and 20” fee structure, or are you looking for potentially lower and varied fee structures provided by some decentralized funds?

- Trust in Technology vs. Humans: Decentralized funds rely heavily on technology, especially smart contracts, while conventional funds bank on human expertise. Which do you trust more?

Once you have considered these aspects, consult with financial advisors or experts in the field to get a comprehensive view tailored to your personal financial situation.

Wrapping Up

Ultimately, The rise of decentralized finance (DeFi) signifies a promising shift in the investment world. While traditional hedge funds remain steadfast, DeFi introduces fresh, innovative opportunities. By aligning with your goals and risk tolerance, you can capitalize on the best of both worlds, paving the way for a balanced and rewarding financial future.