Bridging the Gap: Understanding and Integrating Centralized and Decentralized Finance

In the financial world, two major systems – Centralized Finance (CeFi) and Decentralized Finance (DeFi) – coexist, each with its own set of characteristics and operational philosophies. However, the global financial landscape is increasingly witnessing a convergence of these two realms, creating both challenges and opportunities. But how exactly do these two systems differ, and what does their convergence mean for the future of finance? Let’s take a closer look at CeFi and DeFi to understand their roles in shaping our financial world.

Understanding Centralized Finance (CeFi)

Centralized Finance, or CeFi, is the traditional and long-established financial system we are most familiar with. It operates under the control and supervision of centralized entities, typically banks and financial institutions. These institutions serve as intermediaries in financial transactions, ensuring security, enforcing regulations, and providing a range of financial services. CeFi is characterized by its regulated environment, where oversight bodies ensure compliance, transparency, and consumer protection.

What is Decentralized Finance (DeFi)?

Decentralized Finance, or DeFi, represents a paradigm shift in the financial sector, leveraging blockchain technology to decentralize and democratize financial transactions. DeFi eliminates the need for traditional intermediaries by enabling peer-to-peer transactions on a blockchain network. This system offers increased transparency, reduced transaction costs, and greater accessibility. DeFi’s core is driven by smart contracts – self-executing contracts with the terms directly written into code – which automate and secure transactions on the blockchain.

Key Differences Between CeFi and DeFi

As we mentioned, Centralized Finance (CeFi) and Decentralized Finance (DeFi) each come with their own distinct characteristics. Understanding these differences is crucial for grasping how the financial industry is evolving. Here are the main differences between DeFi and CeFi:

- Control and Governance: CeFi operates under centralized authorities like banks and financial institutions, ensuring regulation and oversight. In contrast, DeFi is based on blockchain technology, allowing for a decentralized, autonomous system without central control.

- Regulatory Framework: CeFi is subject to stringent regulations set by financial authorities and governments, providing a structured environment. DeFi, however, operates with minimal regulatory oversight, offering more freedom but also presenting risks due to the lack of established regulatory frameworks.

- Intermediation: In CeFi, transactions and services are facilitated by intermediaries (banks, for example), which can lead to additional costs and time. DeFi, on the other hand, employs smart contracts on blockchain networks to facilitate direct peer-to-peer transactions, reducing costs and increasing efficiency.

- Accessibility: CeFi systems are well-established with physical infrastructure but can sometimes be exclusive. DeFi opens financial services to anyone with internet access, often targeting those underserved by traditional banking systems.

- Security and Trust Models: CeFi’s security relies on trust in centralized institutions and regulatory bodies. DeFi, however, depends on cryptographic security and the inherent trust in blockchain technology.

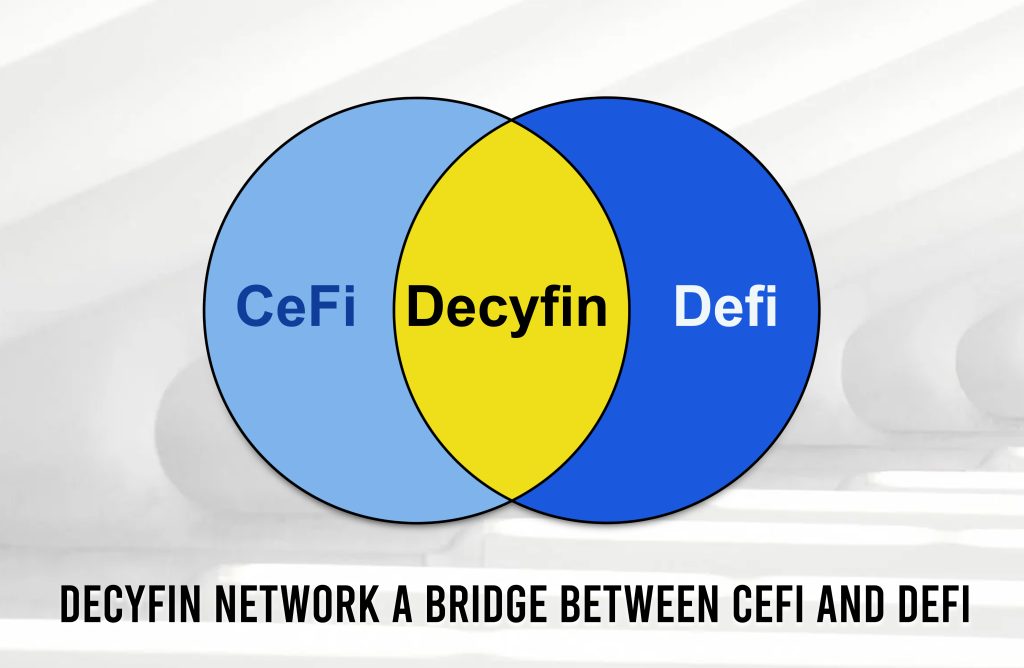

Bridging the Gap Between CeFi and DeFi

As companies look to bridge the gap between Centralized Finance (CeFi) and Decentralized Finance (DeFi), they embark on a journey to integrate two fundamentally different financial systems. This integration is not just a technological challenge but also an opportunity to reshape the financial services landscape. Here is how companies can establish links between CeFi and DeFi:

- Innovative Integration Solutions: Companies need to focus on developing or adopting innovative technologies that can link the centralized infrastructure of CeFi with the decentralized nature of DeFi. This could involve creating platforms that enable seamless transactions across both systems, facilitating a smooth exchange of assets.

- Navigating Regulatory Compliance: One of the major challenges in bridging CeFi and DeFi is the differing regulatory landscapes. Companies must work with regulatory bodies to develop frameworks that are conducive to both systems. This means advocating for regulations that protect consumers and ensure financial stability while also allowing the flexibility and innovation inherent in DeFi.

- Fostering Interoperability: Essential to this integration is the development of interoperable systems where CeFi and DeFi can coexist and interact efficiently. This could involve the use of blockchain technology to create transparent and secure platforms where transactions can be tracked and verified across both ecosystems.

- Educational Initiatives for Adoption: Companies play a crucial role in educating their users about the benefits and risks associated with both CeFi and DeFi. By providing clear, accessible information, companies can help users make informed decisions, encouraging wider adoption and responsible use of both financial systems.

- Building a Hybrid Trust Model: Trust is fundamental in financial transactions. Companies must build a hybrid trust model that combines the reliability and safety of CeFi with the transparency and security of blockchain-based DeFi systems. This could involve employing advanced security protocols and ensuring compliance with financial regulations to build user confidence.

- Collaboration with Industry Stakeholders: Successful integration requires collaboration with various stakeholders, including technology providers, regulatory authorities, and the financial community. Companies can lead or participate in consortiums or alliances to drive innovation and standardization in this space.

Ultimately, the convergence of CeFi and DeFi, facilitated by companies, can lead to a more inclusive, efficient, and versatile financial ecosystem. While the road ahead involves navigating technological complexities and regulatory nuances, the potential for creating a more accessible and diversified financial landscape is vast. Through strategic innovation, collaboration, and consumer education, companies can play a pivotal role in bridging the gap between these two worlds, shaping the future of finance.

Future Outlook: The Convergence of CeFi and DeFi

The financial world stands on the cusp of a significant transformation with the potential convergence of Centralized Finance (CeFi) and Decentralized Finance (DeFi). This evolving landscape offers a glimpse into a future where the best elements of both systems could be harmoniously integrated, paving the way for a more flexible and inclusive financial ecosystem.

- Increased Collaboration and Innovation: The future will likely see increased collaboration between traditional financial institutions and innovative DeFi platforms. This synergy could lead to the development of new financial products and services that leverage the trust and stability of CeFi with the efficiency and accessibility of DeFi.

- Technological Advancements: Advancements in blockchain technology, smart contracts, and security protocols are expected to play a crucial role in facilitating this convergence. These technologies will help overcome interoperability challenges and ensure seamless transactions across CeFi and DeFi platforms.

- Regulatory Developments: A vital aspect of this convergence will be the evolution of regulatory frameworks. As regulators begin to understand and acknowledge the potential of DeFi, there is likely to be a shift towards regulations that accommodate the decentralized nature of blockchain technologies while ensuring consumer protection and market stability.

- Wider Adoption and Accessibility: The convergence of CeFi and DeFi holds the promise of greater financial inclusion. By combining the global reach of CeFi with the accessibility of DeFi, financial services can become available to a larger segment of the population, including those currently underserved or excluded by traditional banking systems.

Conclusion

At the end of the day, the blending of Centralized and Decentralized Finance is all about striking a balance. It is a practical move towards combining the reliability of traditional financial systems with the innovation of blockchain technology.

This convergence is shaping up to be a significant shift in how we handle financial transactions, aiming to make them more efficient and accessible for everyone. While merging these two worlds comes with its set of challenges, the potential benefits – like improved accessibility and enhanced security – are substantial. It is a complex journey, but one that could lead to a more versatile and user-friendly financial environment in the future.