Understanding Asset Conversion in Cryptocurrency

When it comes to cryptocurrency, knowing how to convert your digital assets is as essential as knowing when to buy or sell. So, think of asset conversion as a versatile tool in your crypto toolkit. It is about changing one type of cryptocurrency into another, which is a move, savvy traders often make.

Whether you are aiming to diversify your holdings or lock in gains, understanding this process is crucial. That’s why we have created the following guide, which will explain everything you need to know about asset conversion in crypto.

Understanding Asset Conversion in Cryptocurrency

When it comes to cryptocurrency, knowing how to convert your digital assets is as essential as knowing when to buy or sell. So, think of asset conversion as a versatile tool in your crypto toolkit. It is about changing one type of cryptocurrency into another, which is a move, savvy traders often make.

Whether you are aiming to diversify your holdings or lock in gains, understanding this process is crucial. That’s why we have created the following guide, which will explain everything you need to know about asset conversion in crypto.

The Basics of Crypto Asset Conversion

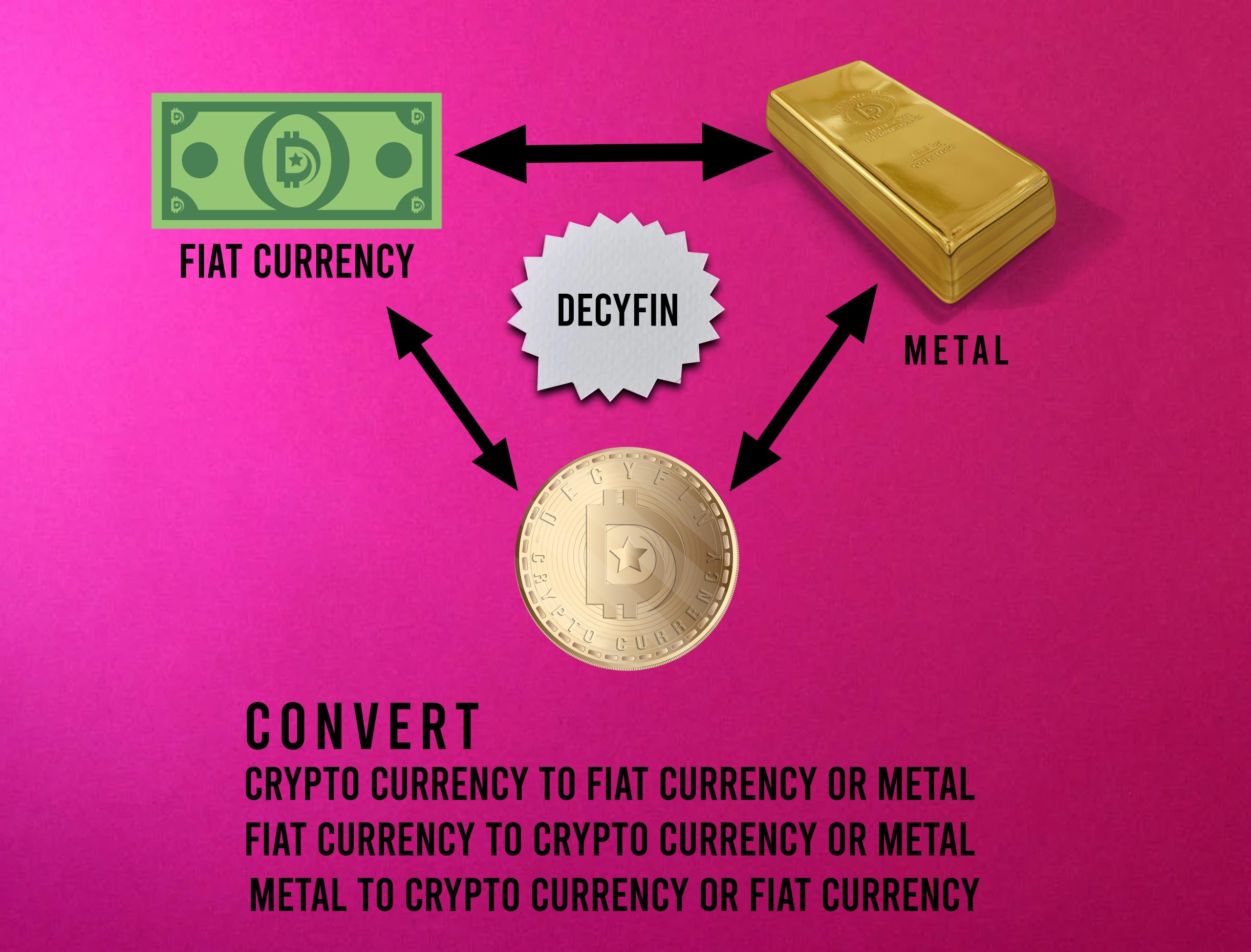

Let us start with understanding what the concept means. Asset conversion in cryptocurrency refers to the process of exchanging one type of crypto asset for another. This can mean trading Bitcoin for Ethereum, swapping a less-known altcoin for a more established one, or even converting crypto into fiat currency (like USD or EUR). Here are some basic points you should know about crypto asset conversion:

- Exchange Platforms: Most conversions happen on crypto exchanges. These platforms offer various pairs of cryptocurrencies for trading.

- Decentralized Exchanges: For those seeking more privacy, decentralized exchanges (DEXs) provide a platform for peer-to-peer trading without a central authority.

- Conversion Rates: The rate at which you can convert one asset to another depends on market conditions and liquidity.

Why Convert Your Crypto Assets?

There are several reasons why an investor might choose to convert their assets. Some of the most popular reasons for asset conversion in cryptocurrency are:

Portfolio Diversification

Diversification is a fundamental investment principle, and in the volatile world of crypto, it is particularly important. By spreading your investments across different types of assets, such as various cryptocurrencies, stablecoins, or even tokenized assets, you can mitigate risk. Hence, if one asset underperforms, the others might offset the loss, potentially stabilizing your portfolio’s overall performance. Diversification is not just about reducing risk; it can also open up new opportunities for growth, as different assets often perform differently under market changes.

Profit Taking

One of the most straightforward reasons for asset conversion is to lock in profits. Say you have invested in a cryptocurrency that has significantly increased in value. Converting a portion of this investment into a different asset or even fiat currency can secure some of the gains you have made. It is a way of ‘cashing out’ while potentially leaving a portion of your investment to continue growing. This strategy is particularly common after a significant bull run in a particular cryptocurrency.

Risk Management

The crypto market is known for its sharp ups and downs. In times of high volatility, some investors prefer to move their holdings into more stable assets. This could mean converting volatile cryptocurrencies into stablecoins, which are designed to maintain a consistent value, often pegged to a fiat currency like the USD. By doing so, you can shield your portfolio from extreme market fluctuations, providing a safe harbor until more stable market conditions resume.

Tactical Asset Rebalancing

Over time, the value of different assets in a portfolio can shift, leading to an asset allocation that no longer aligns with your original investment strategy. Converting assets can help rebalance your portfolio, ensuring that it remains aligned with your long-term investment goals and risk tolerance.

Adapting to Market Trends

Wise investors keep an eye on market trends and technological advancements in the crypto space. Converting assets might be a strategic response to emerging trends or new information, allowing investors to pivot their strategy to take advantage of new opportunities or avoid emerging risks.

Accessing New Opportunities

The cryptocurrency space is continually evolving, with new tokens and projects launching regularly. Converting existing assets can provide the capital needed to invest in these new opportunities, potentially capturing early gains from emerging projects.

\

Understanding Conversion Fees and Costs

Every time you convert one crypto asset to another, it is essential to be aware of the associated costs. These fees can impact the overall efficiency of your transactions, and they include:

- Exchange Fees: When you use a cryptocurrency exchange to convert assets, they usually charge a fee. These fees vary significantly between platforms. Some exchanges might offer lower fees for higher trade volumes, while others might have a flat fee structure. Always check the fee schedule of the exchange before executing a trade.

- Network Fees: These are fees paid to the miners or validators who process and verify transactions on a blockchain network. Network fees can fluctuate based on the blockchain’s congestion level. For instance, converting assets on the Ethereum network might incur higher fees during times of peak activity.

- Slippage: This is especially relevant for large-volume trades. Price slippage occurs when there is a difference between the expected price of a trade and the executed price. In highly volatile markets, or when there is low liquidity for a particular asset, slippage can significantly affect the cost of your conversion.

Best Practices for Effective Asset Conversion

To make the most out of your asset conversions, consider these strategies:

- Choose the Right Platform: Look for exchanges that offer competitive fees, robust security measures, and a solid reputation in the crypto community. Do not just focus on fees; consider the platform’s reliability, user interface, and customer support.

- Understand Market Timing: The crypto market can be highly volatile, so timing your conversions can impact costs. For example, trading during peak hours might offer more liquidity but could also lead to higher fees and prices. Understanding market cycles and liquidity trends is crucial.

- Stay Informed: Keeping abreast of market news, regulatory changes, and technological developments in the crypto space can help you make more informed decisions about when and how to convert your assets.

Asset Conversion and Tax Implications

It is also worth noting that when you are converting assets, you have to consider the tax side of things. In many places, swapping one type of crypto for another is not just a simple trade – it counts as a taxable event. Here are some factors to consider:

- Understanding Taxable Events: If you trade one cryptocurrency for another, it is similar to selling an asset in the eyes of tax authorities. You might have to pay taxes on any profit (or claim a loss) based on the difference in value from when you first got the crypto to when you traded it.

- Keeping Records: It is essential to keep detailed records of every trade. Note down when you made the trade, how much the crypto was worth at the time, and what you traded it for. This information is crucial for accurately reporting taxes.

- Staying Informed on Tax Laws: Tax laws for crypto can vary by country and sometimes change frequently. It is a good idea to stay updated on these rules or consult with a tax professional who knows about crypto.

- Reporting Gains and Losses: When tax time rolls around, you will need to report any gains or losses from these trades. The exact way to do this can depend on your country’s tax laws.

Wrapping Up

As you move forward in the crypto market, remember that understanding asset conversion is a crucial part of your strategy. It is about making smart, informed decisions to grow and protect your investments. So, use this knowledge as a tool to confidently adapt and respond to the market’s shifts. Every smart conversion you make is a step towards achieving your investment goals with the help of cryptocurrency.